By Jim Buchta Star Tribune

October 7, 2017 — 11:04pm

Twenty percent of all house listings in the Twin Cities metro had a price reduction as of August, twice as many as in the spring. The bulk of the markdowns are in the upper-bracket market.

For five long years, the owners of a house at 2104 Kenwood Parkway — known for its appearance in the opening credits of “The Mary Tyler Moore Show” — waited for a buyer. Though the Minneapolis house was in perfect condition, exquisitely staged and on a picture-perfect street in a prime neighborhood, there was only one thing the seller could do to entice a buyer: Reduce the price.

After nearly $1.5 million in markdowns — about half of the original list price — the seller finally hit the sweet spot and got not one, but two offers. The sale closed late last month.

The Twin Cities home market is closing in on a record year of sales even while supply is extremely tight, giving sellers an advantage over buyers. But with winter just around the corner, the competition among shoppers is waning, making it the best time of year to be a buyer.

That change is visible in the growing number of sellers who are cutting prices. Last week, sellers around the metro area offered discounts ranging from a $500 reduction on a $47,000 condo in north Minneapolis to a $505,000 discount on a $2 million architect-designed house on Sunfish Lake.

In August, nearly 20 percent of all house listings in the Twin Cities metro had a price reduction, twice as many as this spring and the highest monthly share in two years, according to an analysis of local listing data.

“It’s price or patience,” said Nick George, a sales agent. “The one thing we can change is price.”

The bulk of the markdowns are happening in the upper-bracket market, where there’s the deepest supply of listings and the smallest buyer pool. Discounts are less common among the most affordable listings, which are most scarce. At the current sales pace, there are still only enough listings priced from $190,000 to $250,000 to last less than two months.

And while a greater share of sellers offered a discount last month, those markdowns are slightly smaller than last year largely because buyers this fall have far fewer options than they did last year, putting buyers on the sidelines and stifling sales.

During the peak spring buying season this year, buyers were essentially paying sellers all of their original asking price or more, according to data from the Minneapolis Area Association of Realtors.

But last week George, who works on the east side of the metro, advised the owner of a townhouse in Oakdale to drop the asking price by $5,000 to $175,000 after it had been visited by 24 prospective buyers without getting an offer. He also had the owners of a two-story house in Woodbury cut the price from $460,000 to $450,000.

“I’m not a fan of discounts,” George said. “I’m a fan of pricing a house right.”

During the spring, both properties would have sold instantly at their original prices, he said. This fall, however, properties have to be in perfect condition, thoughtfully staged and professionally photographed to get the kind of price they might have commanded before the Fourth of July.

While the trend might be troubling for sellers, this seasonal correction is a healthy hedge against another housing price bubble. “People are pulling back a bit; they’re saying ‘I’m going to wait this out,’ ” said Skylar Olsen, senior economist

. “The slowing down is a good sign.”

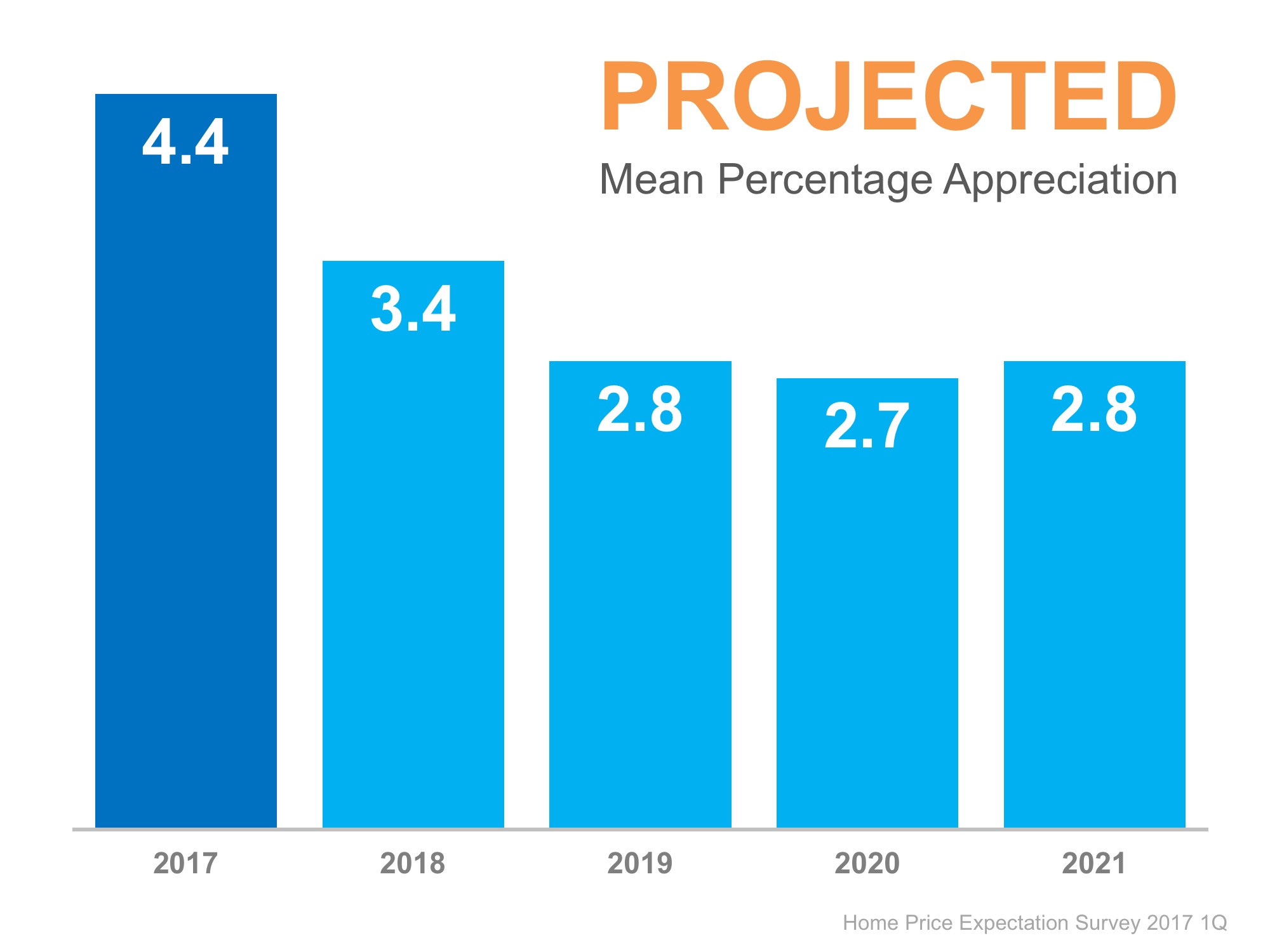

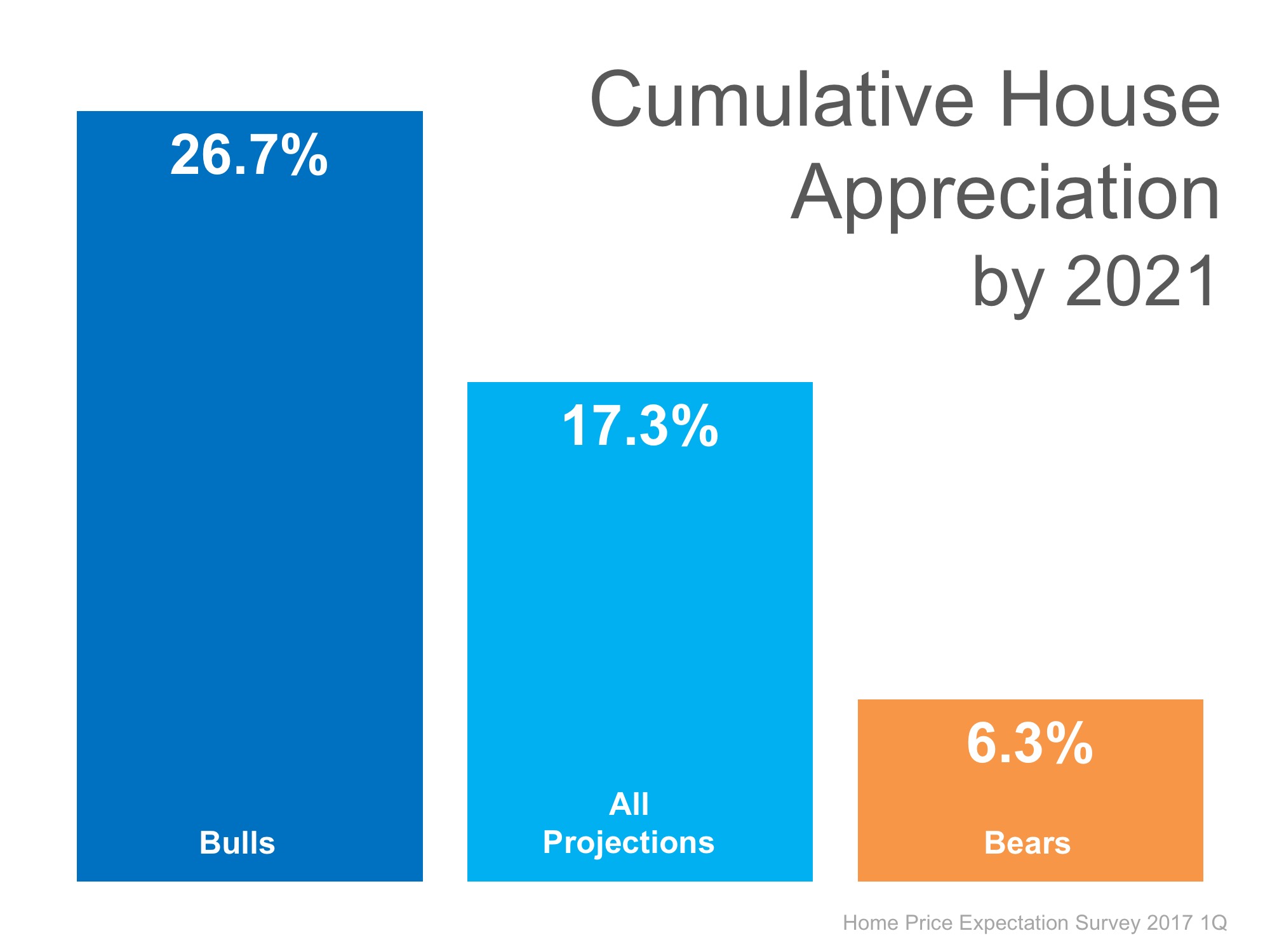

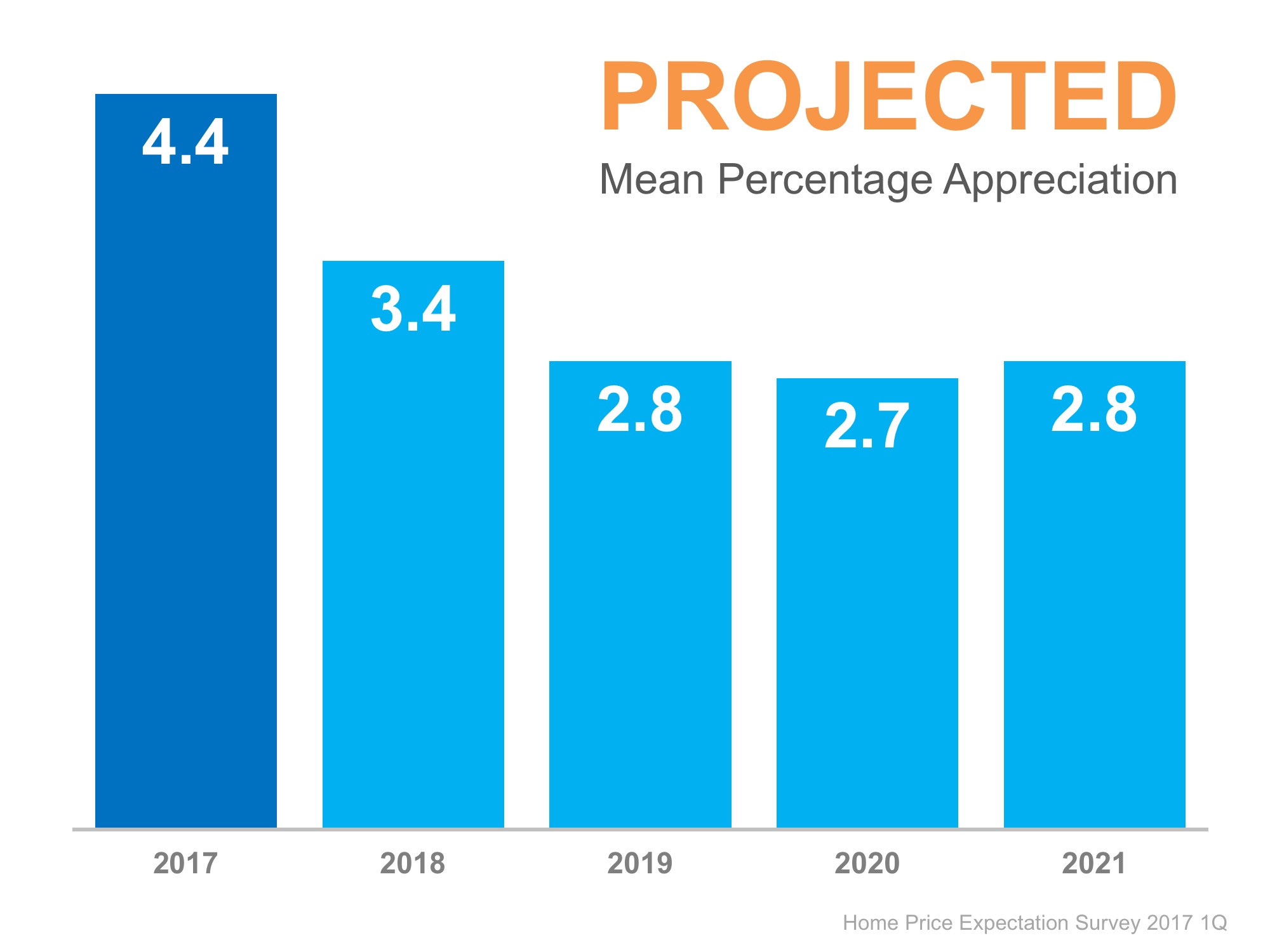

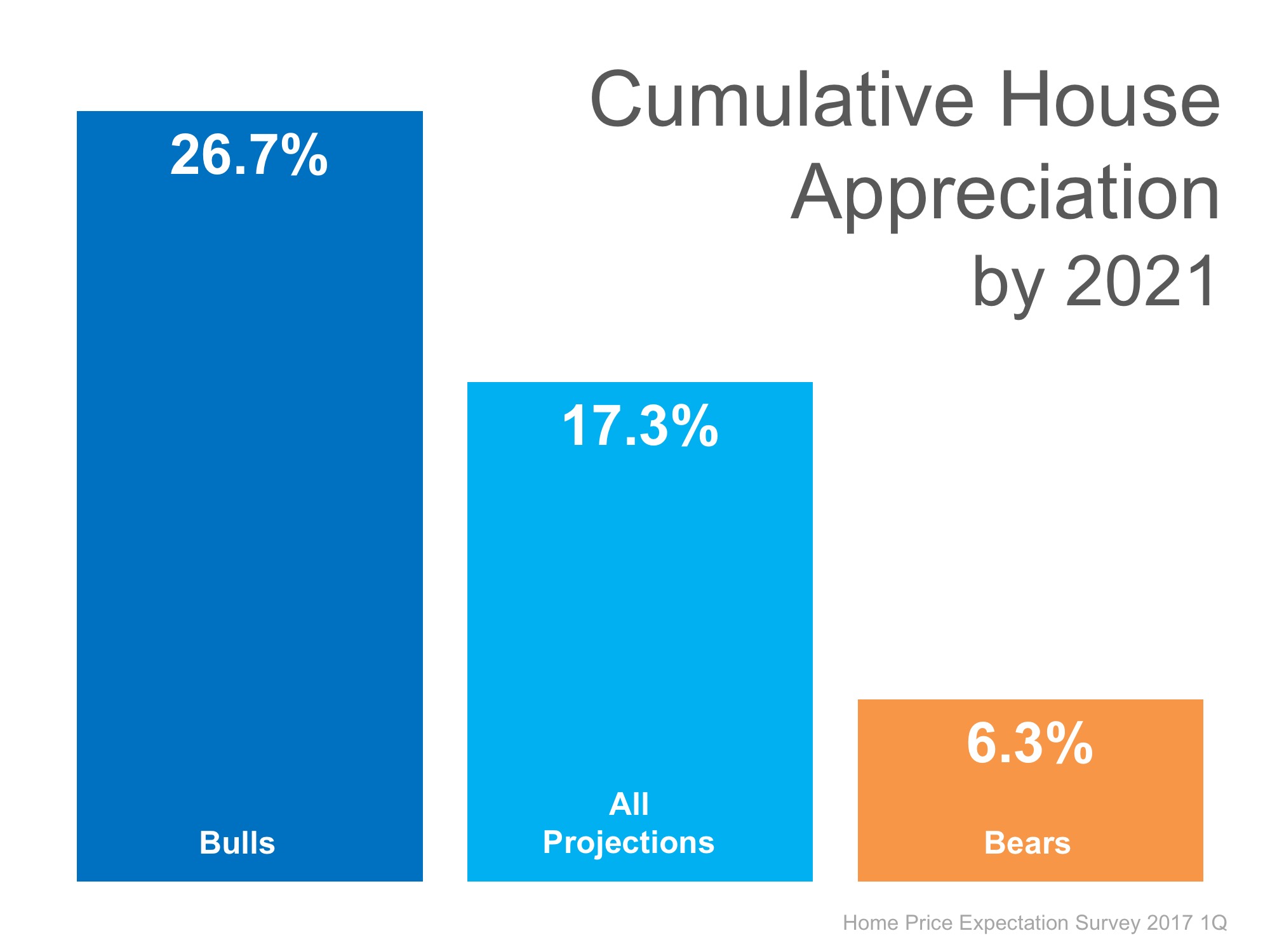

Olsen said while homes in the bottom price tier are appreciating far faster than the top tier — which is why they are less likely to see price cuts this fall — there’s evidence that rising prices in the Twin Cities are slowing slightly after three years of unusually strong gains.

The latest S&P CoreLogic Case-Shiller Minneapolis Home Price NSA Index, for example, still hasn’t exceeded the previous high set in 2007. That’s in contrast to the national index, which hit a new high last summer.

“Sellers can still be confident, but be aware when you’re listing your home that there might not be the fervor that there was in the main selling season,” Olsen said. “Hopefully this a sign of more sane times to come.”